“Oil settles below $39 a barrel for the first time since Feb. 2009″~MarketWatch

Given the dramatic decrease in oil prices, Saudi Arabia could cut investment spending, estimated to be about $102 billion dollars this year, by about 10 percent or more. Although Arab Gulf countries face less oil revenues due to the drop in oil prices, they have not responded like Algeria did last week. On August 17th, the Algerian dinar hit record low as its central bank tries to curb imports and deal with the less oil revenue coming in — which makes up over 90% of the government’s revenue. Due to the fall in oil prices, Algeria’s oil revenues dropped by half. “Government officials expect them to bring in $34 billion this year, down from $68 billion in 2014,” according to Al-Arabiya News.

In response, Algeria devalued its currency — a drop of 105.48 Dinars to a dollar, from 79.6 Dinars to a dollar in 2014. Consequently, the Algerian government is encouraging its citizens to “buy local”. Yet, for the country of 40 million people, growing inflation will add to their cost of living woes: since April, inflation has climbed by almost .5%.

Less Oil Money, Less Spending?

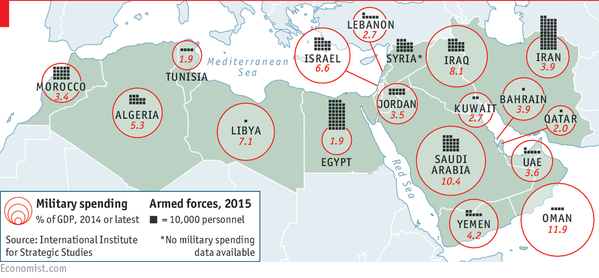

But with all this concern about lower oil revenues and tighter government spending, military budgets in several “pita-consuming” countries remain high. Check out The Economist’s map below charting the percent of each country’s GDP spent on its military — which they argue “only tells half the story”. Absolute expenditures in US dollars would be more useful when considering that military operations should factor in arms purchases as well as research & development. (The data points come from the International Institute of Strategic Studies.) Not surprisingly, oil exporting countries represent some of the largest in military spending as a percentage of their Gross Domestic Product:

- Oman- 11.9%

- Saudi Arabia – 10.4%

- Iraq – 8.1%

- Libya – 7.1%

- Algeria – 5.3%

Regarding Algeria’s currency crisis, it will be a challenge for them to maintain its large military apparatus–especially since it is a major employer of Algerians.

Comparing and contrasting with its other North African neighbors brings other questions to mind. Specifically: HOW does #Libya spend the most of its GDP (7.1%) on military but has the lowest number of military personnel in North Africa (10,000 personnel)? In contrast: How does Egypt, the most populous Arab country, remain at the bottom for military spending when it has the most in armed forces of all Arab countries?! According to the graphic, Iran is Egypt’s only MENA rival regarding personnel. Although Iraq and Saudi Arabia outspend Egypt regarding military personnel, it remains harder to believe that Egypt is allocating so little of its spending towards maintaining its military might — especially considering that all three receive some type of U.S. military assistance.

********

In other country purse strings news: Turkey’s bonds are trading “like junk“, which may prompt a ratings downgrade, according to the DC-based think tank, the Atlantic Council.

Saudi Arabia seeking advice on cutting the budget in wake of oil crash

Saudi Arabia is seeking advice on how to cut billions of dollars from its 2016 budget as a result of a global slump in crude oil prices. The government is working with advisers on a review of capital spending plans and may delay or shrink some infrastructure projects to save money. [Bloomberg, 8/25/2015]

Swiss advance bid to return $40 million stolen from Tunisia

A Swiss official says his country has made headway toward returning some $40 million that was stolen from Tunisia and has been sitting in Swiss banks since 2011. Valentin Zellweger, a legal adviser to the Swiss government, said Monday the federal prosecutor and highest court still have to take steps in the restitution case, but that the process has come a long way. Zellweger declined to specify who had deposited the money in Switzerland, but said it wasn’t former President Zine El Abidine Ben Ali. [AP, 8/24/2015]